Is Boring Retail Dead?

Keith Monaghan

March 5, 2024

Steve Dennis, in his 2020 book, Remarkable Retail: How to Win & Keep Customers in the Age of Digital Disruption, said that retail isn’t dead but boring retail is. Dennis’ experience is of working in tech innovation for large American retailers, from the late 1980’s to early 2020’s.

Speaking post-covid Pandemic, Dennis highlights in his book that even with the Ecommerce revolution that transformed two decades of retail, online sales still only account for 20% of all retail sales in North America. With 80% of overall sales still taking place in physical retail stores, he concludes that of course, retail isn’t dead, but perhaps boring retail is.

But what does Dennis mean exactly by boring?

He references what he believes to be the next tectonic shift in the retail world, comparable to the advent of ecommerce, and which we are all currently living through. He calls it the smartphone revolution. This has allowed most consumers to download shopping apps, compare prices, read (or watch) reviews, and order their items, all in the space of a few minutes. Scarcity no longer exists and there are retailers out there that can ensure speedy delivery processes, no matter where you are situated in the world.

Dennis feels that it’s the mid-market brands that are the most vulnerable in all of this. The brands that are not beating their discount competitors on price or their high-end competitors on in-store experience. He specifically puts the decline of J.Crew and Sur Le Table down to their failure to innovate, and landing too squarely in the unremarkable mid-market, causing them to lose hold of their long-established customer bases. He juxtaposes their fall with the strengthening of TJ Maxx, Lidl, BJ’s Wholesale Club, and Dollar General, all of which are profitable, with some aiming to open hundreds of additional stores across the US in the next few years.

Moving more recently to the UK, on February 13th March, we’ve seen The Body Shop close all of its physical retail stores due the business falling into administration. Eva Thomas, journalist for the Retail Insight Network stated in her recent piece, The Body Shop: what went wrong,

“Once an iconic staple of the British high street, the failure of The Body Shop is a cautionary tale for retailers.”

She also quotes, Dan Hocking, COO of advertising agency TroubleMaker, in the same article, “The Body Shop could have invested heavily in traditional media channels to drive consumers into stores, or pivoted to embrace social media and influencers, winning over a new generation and audience. In doing neither, it appealed to no one.” This statement from Hocking, almost perfectly echoes Steve Dennis’ points in Remarkable Retail.

I’ve always thought of The Body Shop as an impervious high-street store. The phrase too big to fail comes to mind. Has it really been gone out of business due to Dennis’ idea of the boring mid-market retailer or were there several other key factors leading to its decline?

The above picture is from Dublin’s Grafton Street, a shopping street now seemingly filled with strong, upmarket brands, like Space NK, Doc Martens, Rituals, Canada Goose, Ted Baker, and The Lego Shop, each offering their shoppers something a bit more immersive and experiential. These stores are not just places to buy products. They are places where people can get expert advice from happy and knowledgeable staff, browse for as long as they wish, socialise, meet people, and have fun. Perhaps Is this the future of high street retail. Lines of stores where the retailing standards have been set so high that the unordinary can no longer function and are weeded out by the discerning public.

Is the future of Retail at the end of both extremes?

I’m sure if you asked a branding team, they’d tell you their ideal is for a shopper to walk into a store with a blindfold on and be able to tell you where they are by the sounds, the smells, the feel of the products on the shelves, and the overall aura of being in that specific and unique store. Steve Dennis’ points tend to favour the discount and the luxury. Are we now more likely to filter our shopping habits into the extremely low end and the extremely high end, cutting out the middle-market man?

Everyone loves a bargain and trips to the likes of JYSK, IKEA, DFS, and Sports Direct, in order to purchase a large amount of quality goods at very competitive prices is appealing to everybody, no matter what your socio-economic level. Stores of this nature tend to be in retail parks, located amongst one another, and in spaces large enough to contain the vastness of their product selection as well as the vastness of their expected shopper numbers.

It's hard for me to agree entirely with the notion that boring retail is dead, but shopping is so often based on unconscious biases, and one person’s idea of boring can be very different to the next. But with the examples of store closures and administrations in the last number of years tending to be amongst Dennis’ mid-market miasma, perhaps there is more credence for brands to really optimise their omnichannel and embrace whatever consumer trends are thrown their collective direction. Dennis reverts to his phrase that markets are now more consumer led than ever, which I guess is a fancier way of saying “the customer is always right.”

Get Started

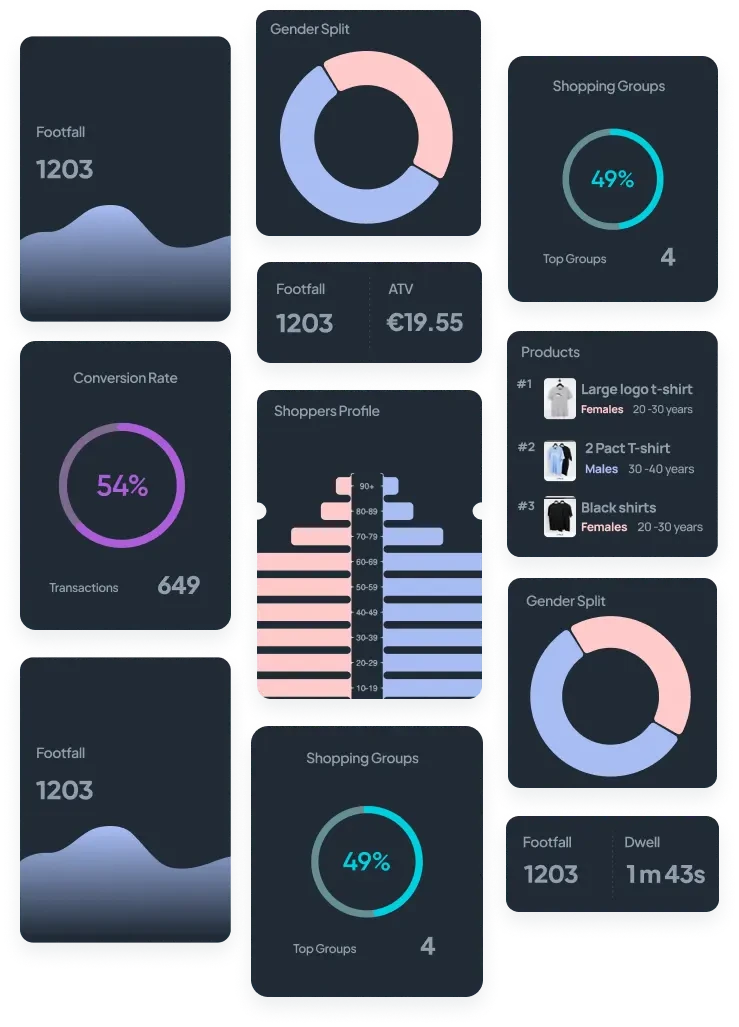

What Gets Measured, Gets Managed!

VisionR mines data directly from shoppers as they navigate stores, empowering retailers with real-time insights to maximise their decisions & revenues.